Markets Philippines

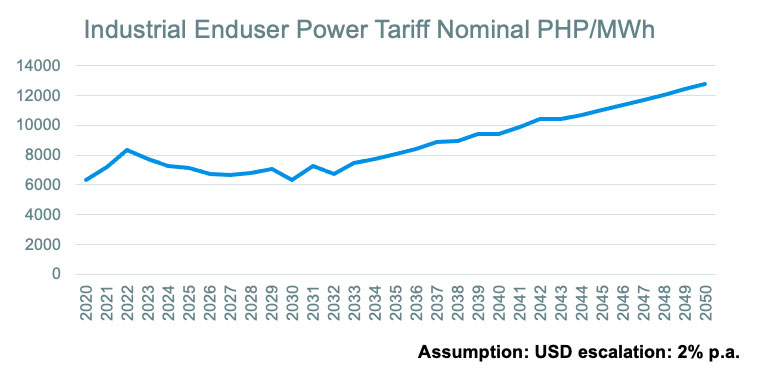

In the Philippines, as a result of hefty taxes and the absence of subsidies, electricity tariffs are very volatile. Since 2004, they have escalated at an annual average rate of 2.4%. The government expects demand to rise by 6% each year, with supply struggling to keep up.

Hefty taxes and the absence of subsidies lead to high and volatile tariffs in the Philippines

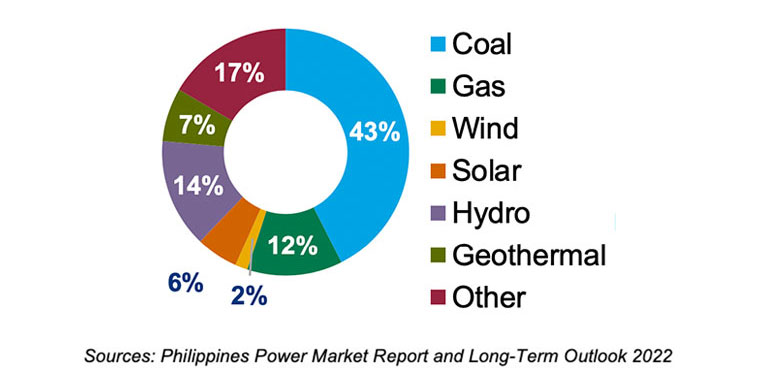

Installed Power Capacity (2021)

- Diverse generation mix, but supply capacity is below demand

- About 45.9% of demand comes from C&I customers

- More than 40% of companies rely on diesel generators

Average Electricity Prices (Industrial User)

- Tariffs are not subsidized

- Currently: 18-22 US cents/kWh (among highest globally)

- Oil prices for gasoline and diesel surged in 2021, and continued in 2022

- Planned changes in fuel taxes are likely to shore up tariffs for C&I customers

Regulation

Government Lead Initiatives:

- Philippines Energy Plan 2012-2030: to reach 50% renewable energy in primary mix by 2030, with +9.9 GW new renewable generation capacity, including 5.4GW hydro, 2.3 GW wind, 1.5GW geothermal, 350 MW solar (already surpassed) and 277 MW biomass

- Policy makers are considering Renewable Portfolio Standards (RPS) to further develop solar and wind

- Conditional greenhouse gas reduction target of 70% below business as usual (BAU) levels by 2030 (2015)

Implementation:

- Net metering size limit have increased to 1MWp as approved by the Energy Regulatory Commission of the Philippines

- Renewable energy sector is open to full foreign ownership

- Building owners now required to use renewable energy among other measures in the Energy Efficiency and Conservation Law