Vietnam - Energy Market

Electricity Vietnam (EVN) is the vertically integrated national power company responsible for about 58% of Vietnam’s generation. Through its various subsidiaries, it is responsible for operating the wholesale market, transmission and distribution. The Vietnam Wholesale Electricity Market still relies on a single buyer model.

Vietnam’s Energy Sector Overview

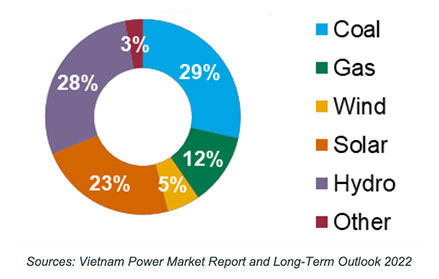

Installed Power Capacity (2021)

- Demand expected to grow by 7.9% annually from 2022 to 2026, exceeding supply by 15 TWh in ’23

- Solar and Wind installed capacity in 2021 is 28% ~ 21.5 GW

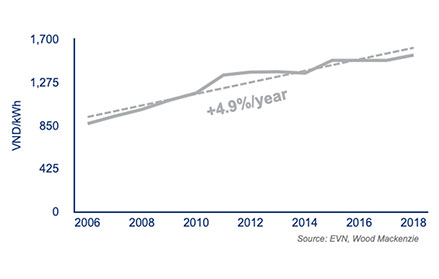

Average Electricity Prices (Industrial User)

- Industrial Tariff for 22kV Buyer is currently around 8.38 c/kWh or 1,931 VND/kWh and expect to increase 2% and 4.6% for USD and VND tariff respectively

- Recently, EVN committed not to increasing power price in 2022. In the long run, grid price forecasted to increase by 4.6% annually (Source: Wood Mackenzie)

Regulation

Government Lead Initiatives:

Renewable Energy Sources targets: Vietnam Renewable Energy Target 2016-2030 (PDP 7):

- 6.5% renewable energy generation by 2020 and 10.7% by 2030

- 710-800MW of wind by 2020 and 6GW by 2030

- 850MW of PV by 2020 and 12GW by 2030

Carbon reduction target – INDC 2015:

- Unconditional: by 2030, GHG reduction of 8% compared to BAU

- Conditional: up to 25% if international support

Implementation:

- Net metering (Circular 16): on an annual basis to rooftop PV systems connected to the grid, on buildings with bidirectional meters. Excess electricity credits after one year will be sold to EVN at the FiT rate of 2086 VND/kWh (9,35 c$/kWh) for 20 years, with annual adjustment to the USD/VND exchange rate

- FiT for systems < 1 MW can be installed outside the development power plan. For > 1 MW, mandatory power sector licensing