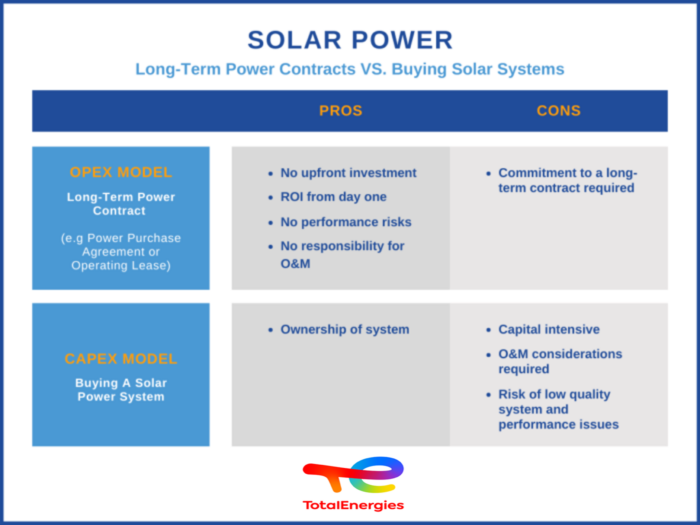

The key differences between buying a solar system and signing up to a long-term power contract e.g. Power Purchase Agreement or Operating Lease.

Companies are increasingly looking to on-site solar projects to cut costs and carbon footprint sustainably. Some TotalEnergies customers have reduced their power costs by 30 to 40 per cent – saving USD millions annually. These customers have been able to benefit without needing to make a major upfront investment.

Generating cleaner electricity with solar power also reduces businesses’ carbon footprint and avoids thousands of tons of carbon dioxide emissions over the years. This supports a company’s environmental sustainability commitments, in line with government renewable energy targets.

The key question however is whether to purchase a solar system or sign up to a power purchase agreement (PPA). Here are some considerations.

CapEx Model – Buying a Solar Power System

Many companies would like to implement solar but cannot justify the large upfront investment. It normally takes 5 to 10 years to receive savings equivalent to the initial investment (payback period). It then takes another 10 years or so to make a reasonable return on investment (ROI). For many companies, this payback profile does not fit with internal governance rules. By investing in their core business, they see much better ROI.

Payback relies heavily on the solar system being operated and maintained by a high quality (O&M) team. Solar savings do not cover the cost to hire this team so companies outsource this service. In Southeast Asia, there are very few experienced O&M providers which means that systems tend to perform worse than expected. Some systems experience 20 to 30 per cent under-performance. This extends the payback to 10 to 20 years and reasonable ROI to over 30 years.

Incentive alignment is critical. When an installer sells a solar system, they are incentivised to maximise the price and minimise their costs. They can only do this by cutting corners on equipment quality and project delivery. Inevitably, these systems perform poorly, are unsafe and break-down regularly.

Benefits:

– Ownership

Downsides:

– Capital intensive

– Operation and maintenance has to be factored in

– Risk of low quality system and performance issues

There is another option which ties the service provider into the same alignment as the customer.

OpEx Model – Long-Term Power Contracts

In a long-term power contract, the service provider agrees to install a system, finance the capital expenditure (CapEx) and operate as well as maintain the system for the life of the contract. The customer just pays a monthly bill for any power produced by the solar system. Hence, the provider is incentivised and responsible for repairing any equipment and ensuring the system is optimised to maximise the power output. They can only invoice for power that has been generated by the solar system.

The lack of upfront investment for customers is a key reason why over 90 per cent of all Commercial & Industrial customers select this approach over the CapEx Model. Usually, the price for the solar power is 30 to 40 per cent cheaper than the grid. Customers therefore receive savings from the first day, and do not have to wait decades to see an ROI.

It is a hassle-free way to reap the benefits of renewable energy without companies having to make large upfront investments. Furthermore, customers don’t have to deal with the long-term operation and maintenance.

Benefits:

– No upfront investment

– ROI from the first day

– No performance risk or responsibility to repair the system – solar provider offers all-inclusive contract with operation and maintenance

Downsides:

– Customers need to be able to enter into a long-term contract

Ready to go solar and save money as well as do your part for the environment?

Speak to TotalEnergies Distributed Generation today to find out how big a difference solar power will make for your business.

See some of TotalEnergies Distributed Generation’s projects in Southeast Asia here.